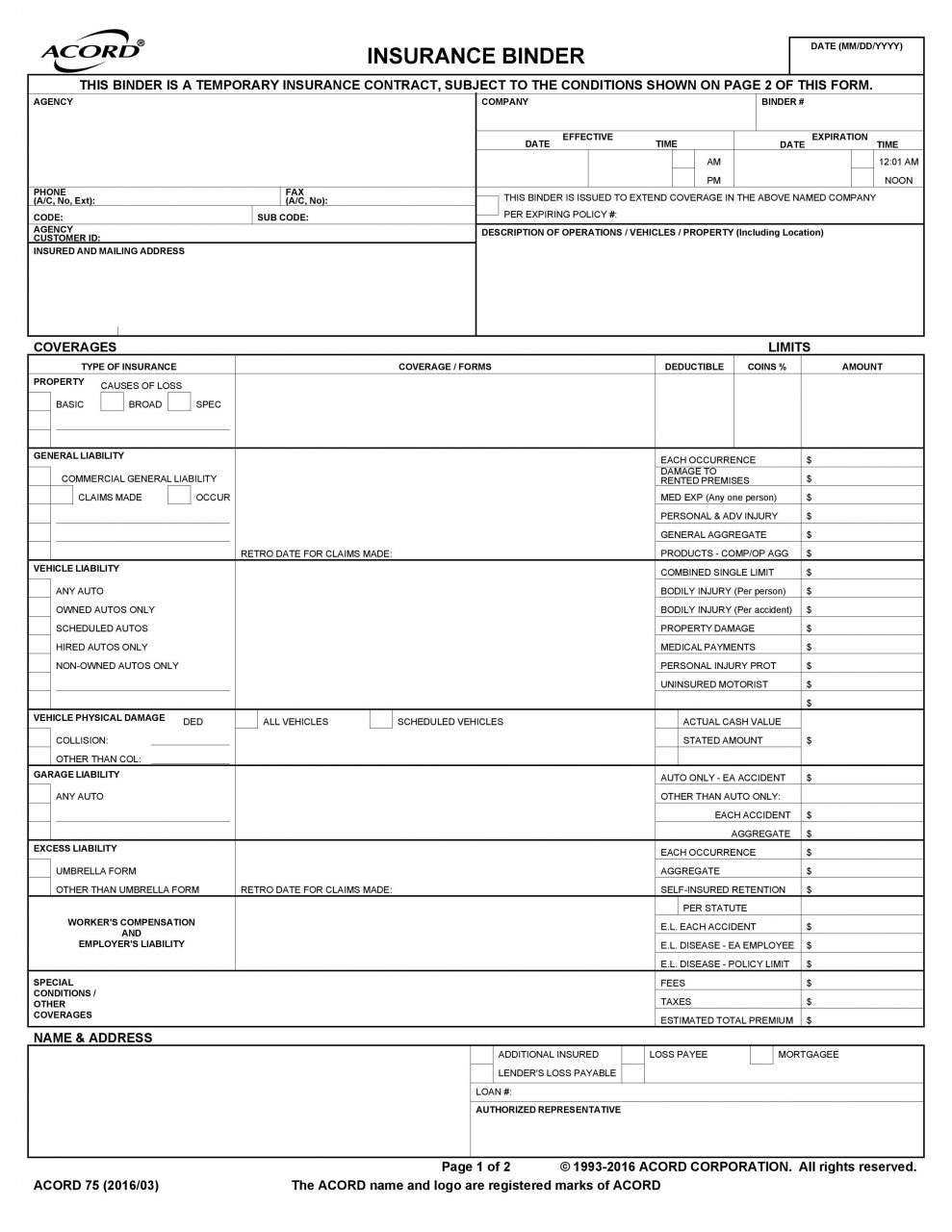

Your insurance binder can be your proof that you have insurance until your official policy has been underwritten

After you receive the official homeowners insurance policy, the binder becomes invalid. As such, it contains your homeowners policy details, including the deductible and coverage limits. The document essentially serves as a provisional insurance policy. A homeowners insurance binder is a document that you’ll get from your insurance agent that proves that you’ve bought homeowners insurance.

0 kommentar(er)

0 kommentar(er)